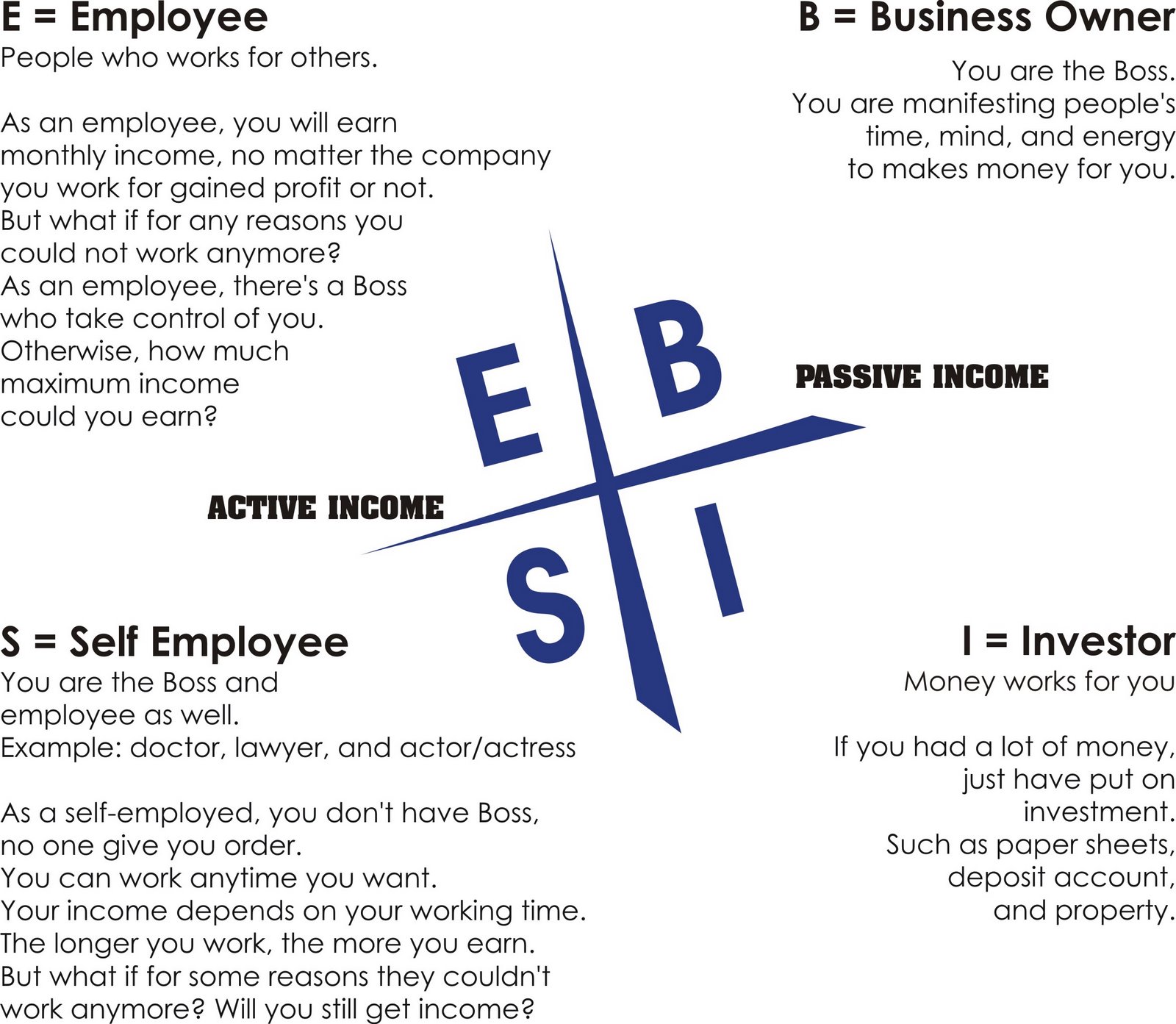

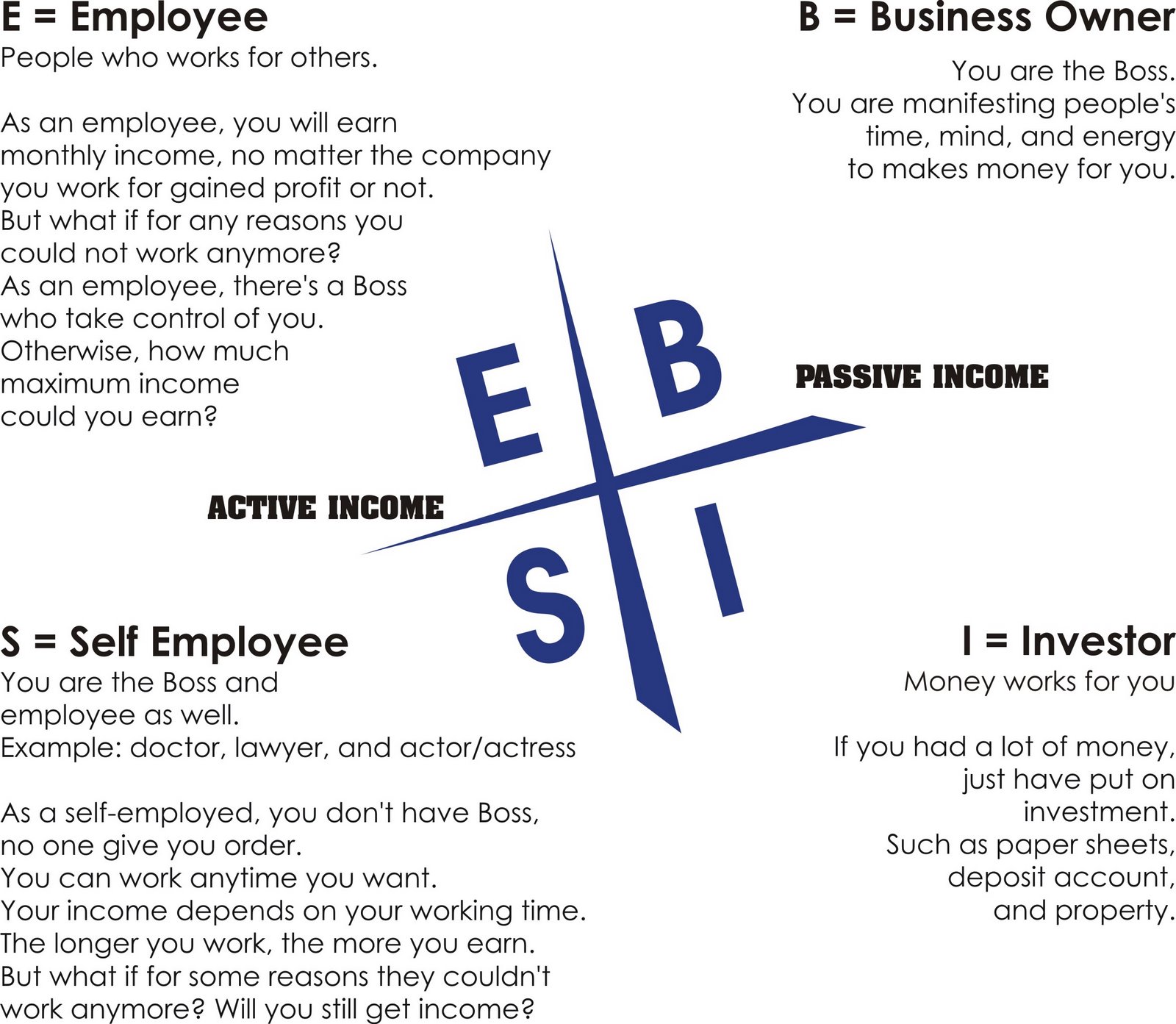

The better strategy is to focus on a few investments, not on diversification. But as Warren Buffett advises, diversification is a way not to lose money, rather than a way to make money. E- and S-quadrant stock market investors focus on diversification.The opportunity for real wealth lies in the I-quadrant. The Investor, or the I-quadrant, uses money to make money.The Business owner, or the B-quadrant, has a system where other people do the work- like Henry Ford, who surrounded himself with smart people who knew all the answers so that he could concentrate on new ideas.The key to success in this S-quadrant is to know when to get out and move onto something new.

Nationally, nine out of ten such businesses fail in the first five years, mostly due to a lack of experience and capital.

Self-employed is the riskiest quadrant. They essentially own their job and is likely a hardcore perfectionist who values independence and expertise. The Self-employed person, or the S-quadrant, does not want their income to be dependent on other people. This person works within someone else's system to earn money. Employee, or the E-quadrant, values security above all else and seeks the safety of a long-term contractual agreement. Each of these four categories, or quadrants, has its strengths, weaknesses, and characteristics. Everyone can be categorized according to how they get their money: Employee, Self-employed, Business owner, or Investor. Read this book summary to discover a new approach to wealth and risk management and apply your learnings in real life so you can start with small steps that can eventually lead to substantial assets. For the same reason, I also highly recommend Increase Your Financial IQ: Get Smarter with Your Money by the same author.Do you work increasingly long hours with nothing to show for it, or struggle to have enough left to save after all the bills? Robert Kiyosaki, author of the viral book Rich Dad's Cashflow Quadrant: Rich Dad's Guide to Financial Freedom, explains how anyone can move to the other side of the Cashflow Quadrant and flourish with financial independence as a business owner or investor. This book would help students realize they have more options to choose from, so they can prepare themselves better, during their college years. I think this book should be mandatory for first-year college students. But we often don’t see other options.Īfter reading this book you may discover other, new options that are significantly better than the one you’re currently following, but have never been exposed to. Many of us feel that earning a living has basically one single path – and we’ve already found a solid path. He delves into things that most traditional schools rarely talk about. He explains options and alternatives that are accessible to you – that will guide you to financial freedom. In his book, Rich Dad Poor Dad, he began exploring the topic of the Cashflow Quadrant, but in this book he goes into much greater detail.

This book will open your eyes to new options and more avenues for financial wealth.

#Cashflow quadrant book review free

Our shared definition of success is often to be “better than average.” This book looks beyond financially secure, and into how you can obtain enough wealth to become financially free from your 8-to-5 job. Our traditional schooling taught us to basically follow a set of traditional rules, to be successful. Most of us work to make money, just to stay financially stable.

Rich Dad’s CASHFLOW Quadrant: Rich Dad’s Guide to Financial Freedom

0 kommentar(er)

0 kommentar(er)